|

pet insurance company raleigh nc guide for careful buyersRaleigh's pet owners face a familiar puzzle: coverage quality versus cost, with local veterinary realities shaping the right choice. This overview stays practical, value-focused, and rooted in how policies behave once a claim hits a Wake County inbox. What matters most in RaleighEmergency care is accessible - NC State Veterinary Hospital (Raleigh) and BluePearl (Raleigh) handle complex cases - so your plan's annual limit, reimbursement rate, and deductible matter more than provider "networks." Nearly all plans reimburse care from any licensed veterinarian. That's useful across Raleigh, Cary, and the Triangle. Core coverage that actually moves the needle- Accident + illness: fractures, GI obstructions, cancer, infections.

- Hereditary and congenital conditions: hip dysplasia, cruciate ligament injuries, cardiomyopathy.

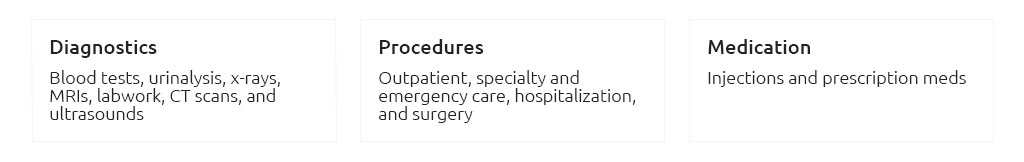

- Diagnostic depth: imaging (X-ray, ultrasound, MRI), pathology, and hospitalization.

- Prescription meds and specialty referrals: oncology, neurology, cardiology.

- Optional add-ons: dental trauma coverage, alternative therapies, exam fees.

Price drivers you'll see in Wake County quotes- Breed and age: brachycephalic dogs and purebreds trend higher; older pets face steeper rates and restrictions.

- Coverage design: higher annual limits and low deductibles raise premiums; accident-only is cheaper but far narrower.

- Local cost base: specialty care pricing in Raleigh influences claim payouts, then renewal rates.

- Regulatory backdrop: NC filings and DOI oversight shape, but don't cap, what you pay after loss experience.

How to evaluate a pet insurance company (Raleigh-specific)- Claim cadence: median days to pay, weekend processing, and clarity on required records.

- Policy language: define "pre-existing," "bilateral," and cruciate waiting rules in plain terms.

- Coverage depth: does it include exam fees, rehab, and dental trauma; what are per-incident caps?

- Customer support: extended hours in Eastern Time helps during late-evening emergencies.

- Financial steadiness: insurer or underwriter track record, not just the brand.

- Local usability: easy reimbursement for NC State or BluePearl; any direct pay options? (Some offer it case-by-case.)

- Complaints and patterns: skim NC DOI complaint trends and consumer forums for recurring denial themes.

A small, real-world momentAt a Raleigh dog park, a bee sting turned into facial swelling. The owner headed to an emergency clinic, snapped the invoice, and submitted a mobile claim in the waiting room. The insurer requested the last two years of records - a speed bump - but once uploaded, reimbursement landed the following week. The take-home: keep digital vet records handy to cut days off your timeline. Typical cost contours (illustrative)For mixed-breed dogs around age 2 - 5, accident-and-illness plans in Raleigh often fall into a mid-double-digit monthly range; cats trend lower. Premiums climb with richer limits and older ages. Treat these as directional only - breed, deductible choices, and prior conditions can swing numbers significantly. Pragmatic caveats that change outcomes- Waiting periods apply; cruciate and hip dysplasia often have special windows or exams.

- Pre-existing conditions are excluded; some curable issues can re-qualify after symptom-free intervals.

- Bilateral clauses may exclude the second knee if the first had issues before enrollment.

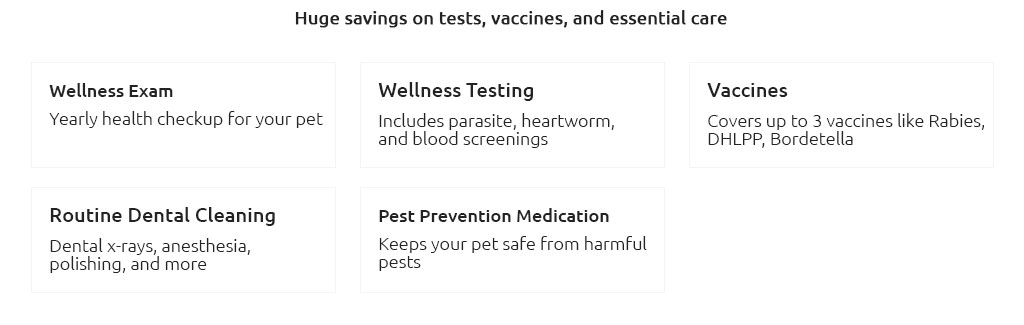

- Wellness add-ons can be convenient but may cost more than routine care out-of-pocket if you're disciplined.

- Exam fees and taxes aren't always covered; read the fine print.

Raleigh relevance: where coverage meets careBecause you can visit any licensed vet, focus on predictability: stable premiums year-over-year, transparent fee schedules, and claim support that understands high-ticket specialty items commonly seen at NC State and regional emergency hospitals. Quick comparison workflow- Gather medical records and note any prior issues in plain language.

- Choose two deductible targets (e.g., $250 and $500) and one annual limit floor (e.g., $10k) to A/B test quotes.

- Download sample policies; search for "pre-existing," "bilateral," "cruciate," "dental," and "exam fee."

- Call or chat to confirm gray areas; keep a written summary of reps' answers.

- Skim recent NC complaint logs for your shortlisted brands.

- Enroll before known procedures are discussed in records to avoid exclusions - but never misstate history.

Bottom lineA strong pet insurance company for Raleigh pet owners balances fast claims, clear exclusions, and flexible limits you can live with. Optimize for coverage you'll actually use in a city with robust specialty care. Expect good protection, but set realistic expectations: policies ease financial shocks; they don't eliminate them.

|

|